Last April marked five years since the introduction of “pension freedoms” which provided people with more choice and flexibility in their retirement options. However, approximately half of people approaching retirement say that they don’t know enough to plan for their income after they stop working.

Pension Wise offers guidance to pensions savers on what they can do with their pension pots, how to shop around for retirement products, and what to look out for with regards to taxes, fees, and scams.

Today we are publishing the results of a randomised controlled trial which encouraged pensions savers approaching retirement to take up Pension Wise guidance before they access their pension savings. We find that if we clearly explain the nature and purpose of guidance, offer it as a normal part of the pension access, and make it easy to book an appointment, the proportion of pension savers who book an appointment increases almost fourfold.

Making the case to increase the uptake of pension guidance

The guidance offered by Pension Wise is very highly rated. Over nine in ten customers who had appointments were satisfied with the service, and 95% of appointment customers report that they have already recommended the service or are likely to do so. However, despite its benefits, members of both the House of Lords and House of Commons recognised that not enough people were taking advantage of it before accessing their pension savings.

In response, as part of the Financial Guidance and Claims Act Parliament set out a requirement for pension schemes to refer customers to appropriate guidance in a way that engaged them and wasn’t seen as a box-ticking exercise. Ministers committed to testing different approaches to see what works best, and the Money and Pensions Service (MaPS) commissioned the Behavioural Insights Team to undertake this research.

The Stronger Nudge intervention

The Stronger Nudge interventions aimed to encourage the uptake of guidance by presenting the offer of guidance as a normal part of the customer journey, emphasising its benefits, noting the positive experience others had had with the Pension Wise service, and making a booking as soon as possible. We decided to design the interventions in this way because we know that small frictions can have a disproportionate impact on decisions. Furthermore, people are often more likely to make a choice if they feel that others are also making the same decision.

The interventions were delivered by call handlers at three pension providers: Aviva, Hargreaves Lansdown, and Legal & General. The interventions changed the way in which pension providers talked about guidance to pensions savers. In the current business as usual model – the ‘control group’ – call handlers deliver a standardised text which asks the customer whether they received guidance. If they haven’t, the call handler explains that Pension Wise offers free and impartial guidance service and asks the customer if they want the contact details to make an appointment.

The Stronger Nudge interventions required the call handlers to provide more detail about the Pension Wise service, and explain that they were entitled to a free appointment, that would last about 45 minutes, and that feedback from other customers had been overwhelmingly positive. There were two variations of the intervention: one group of customers were offered an appointment to be booked by the call agent they were already talking to – the ‘online booking’ group – whilst others were transferred to a Pension Wise appointment specialist who could discuss the offer with them further, and book an appointment – the ‘warm transfer’ group.

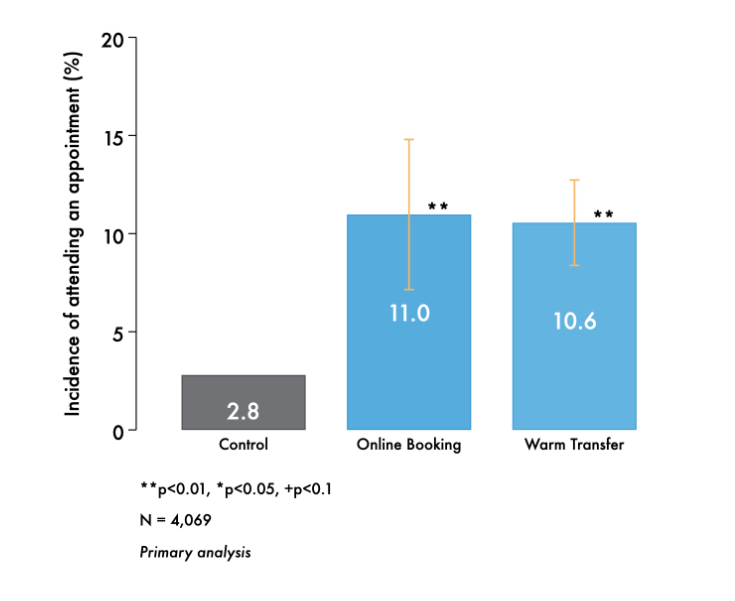

Figure 1: Incidence of attending a Pension Wise appointment within six weeks

We found that the Stronger Nudge interventions were successful in encouraging pension savers to book and attend a Pension Wise appointment. Of those pension savers who did not report having had guidance or advice in the previous year, approximately 11% received Pension Wise guidance as a result of the interventions in comparison to approximately 3% in the control group. There was no evidence of a significant difference between online booking and the warm transfer interventions.

In follow-up interviews with a number of trial participants, we found that those most likely to take up an appointment had a moderate level of knowledge but hadn’t yet decided on their pensions options. The most frequently given reason to decline the offer of a Pension Wise appointment was that the pension holder felt they already had sufficient pension knowledge. Provider delivery staff reported that the interventions were convenient and easy to manage. Unsurprisingly, the Warm Transfer process was considered more time-efficient for staff.

Further thoughts

What we do with our pension savings is arguably the most important decision we will make when we retire. And yet, many people call their pension providers to access their pension savings without having a plan in place and without knowing how guidance can help them. By simplifying the process and highlighting the benefits of guidance, the Stronger Nudge interventions had a significant impact on the uptake of guidance.

We are excited with the success of the Stronger Nudge interventions and we hope to build on these findings and test the impact of further behavioural interventions on engagement with pension savings. For example, as part of our Financial Capability Lab partnership with MaPS we are working with Royal London to encourage more people to take up pension guidance to ensure they have an adequate retirement income. To recognise the impact CoVID may have on finances, we are also extending this to general money guidance for people who may have money concerns.

We welcome more partners who are willing to test innovative interventions which apply behavioural insights to help people manage their money better and improve their financial wellbeing. If you are interested in partnering with us get in touch: pantelis.solomon@bi.team.