Think about yourself the day after you retire. Will you be spending more time with your friends and family?

Does this question make retirement feel closer, more real? In a recent study with over 70,000 people, this simple prompt substantially increased engagement with retirement planning. It was more effective than stating the benefits of retirement planning, and even outperformed asking people what activities they will spend their time doing in retirement.

Although retirement planning is a key step towards achieving financial security, making a retirement plan is often a challenge. It’s hard to start and easy to put off. It’s easy to get overwhelmed and drop out, and it can be hard to get the right advice. Many people get stuck somewhere between intending to make a retirement plan and actually making one.

The Behavioural Insights Team (BIT) partnered with the Investor Office of the Ontario Securities Commission (OSC) to explore how insights from behavioural science can shed light on what keeps people from making retirement plans and what public and private sector organizations can do about it. Our report, based on a literature review and qualitative research with pre-retired Ontarians and financial advisors, identified 9 behavioural barriers to creating a retirement plan and 30 potential interventions and strategies to address them.

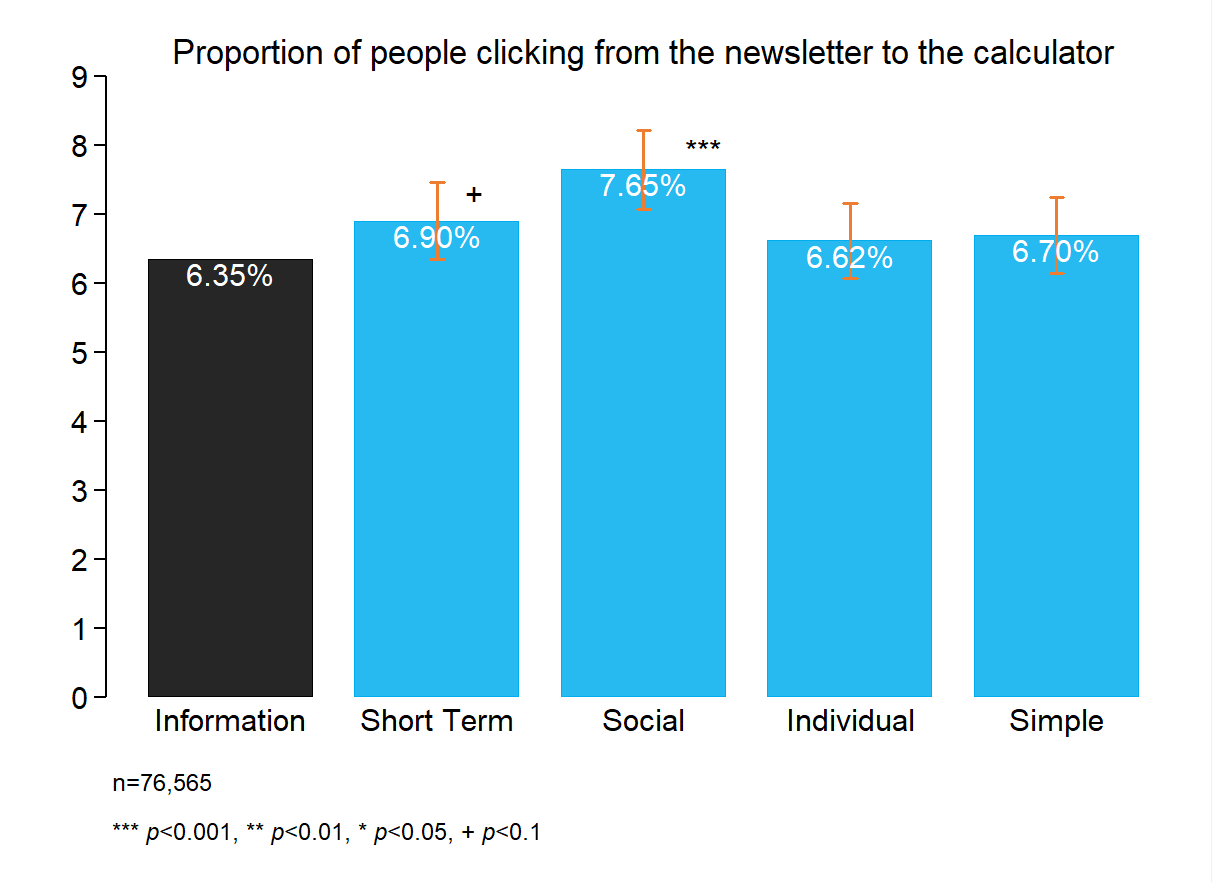

The report also includes findings from a field experiment we conducted. We tested 5 messages, including the one asking whether recipients would be spending more time with friends and family after they retire. These messages were sent to over 70,000 Ontario Public Service employees. Each encouraged recipients to access the Government of Canada’s online Canadian Retirement Income Calculator. They were developed and tested in partnership with the OSC, the Government of Ontario’s Behavioural Insights Unit and Employment and Social Development Canada.

Asking people to think about who they would spend time with in their retirement worked best in getting recipients of the email to click through to the retirement calculator. It did better than messages focused on information about retirement planning, short term benefits, the activities people could do after retirement, and the simplicity of completing a retirement plan.

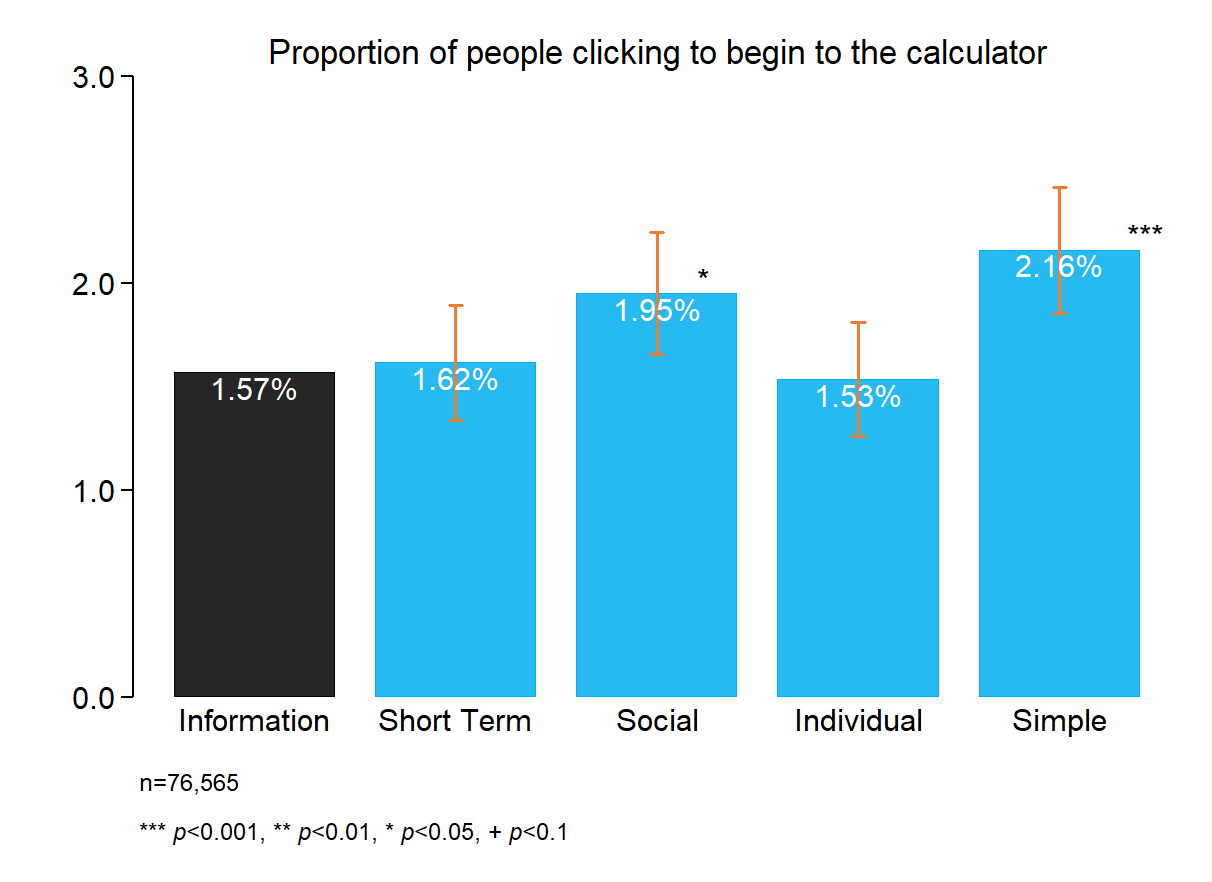

We also examined which messages were most effective in more sustained engagement (clicking through from the calculator landing page into the calculator tool itself). For this outcome, the message emphasizing the simplicity of creating a retirement plan was most effective.

The results of this trial suggest that making the future feel more salient—especially through a social frame—effectively sparks interest in retirement planning. But to move from that spark into a planning process, we should emphasize (and enable) simplicity. You can read more on these findings in our full report, out today.