With most people spending at least 25 years in retirement, deciding what to do with your pension pot is one of the most significant financial decisions you can make. And yet it is also one of the most complicated.

Today we are publishing the results of three randomised control trials encouraging UK consumers to access pension guidance when they are approaching retirement.

Helping people make an informed decision about their pension

In April 2015, the rules were changed in the UK to give people greater freedom in accessing their pensions. One of the biggest changes was that those approaching retirement no longer had to purchase an annuity with their defined contribution pension. Instead they could take out a cash lump sum or leave the money invested in stocks and drawdown over time.

The decisions people make about their pensions – including whether to purchase an annuity and whether to shop around – have a huge impact on the amount of money they have to spend in retirement. The Financial Conduct Authority found that 37 per cent of pensioners did not shop around at all before buying an annuity because they did not feel capable of understanding the vast amount of information available in order to make an informed decision. These low switching rates matter since it is estimated that consumers miss out on as much as £11 million annually by not shopping around for annuities.

To help people make a decision in this complex environment, people in the UK are given access to free and impartial guidance via the phone or face-to-face, through the UK’s Pension Wise service. Those eligible for the service are notified of Pension Wise through a signposting letter included in the standard wakeup information pack sent to customers six months before they are due to retire.

We wanted to help more people make an informed decision about what to do with their pension. BIT ran three randomised-control trials to encourage people approaching retirement to seek pension guidance, in collaboration with the UK Government’s Pension Wise service and three pension providers (Liverpool Victoria, Standard Life and Royal London).

Liverpool Victoria: the Pension Passport

In collaboration with government and industry, we designed a Pension Passport which was tested in collaboration with Liverpool Victoria (LV=). The Pension Passport consolidated essential information from the usual 50–100-page pack issued by the industry – sent to those approaching retirement – onto one side of A4 paper.

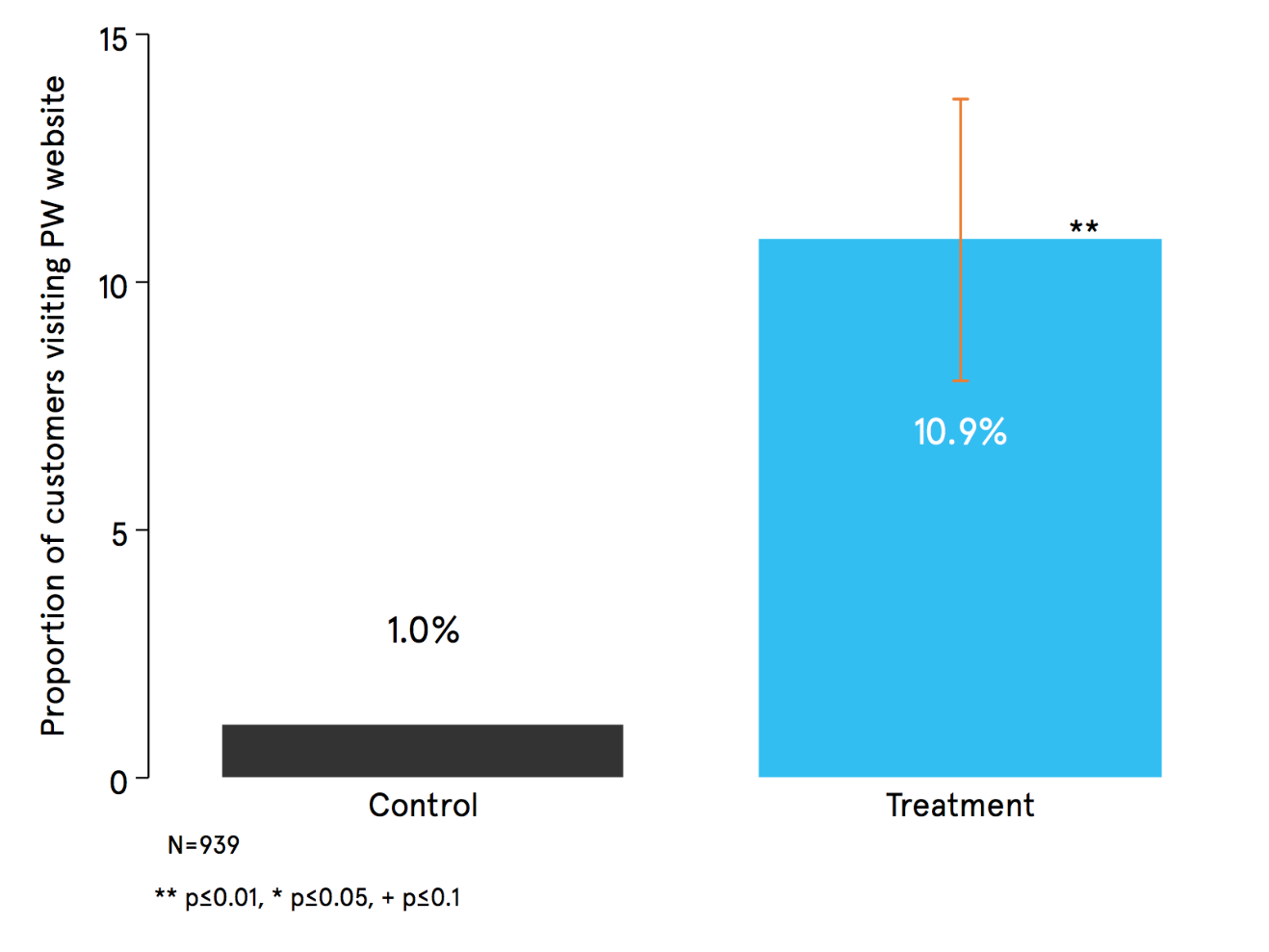

The Pension Passport included the personalised information a customer needs to access open-market retirement product options and a clear call to action to visit the Pension Wise website. Those receiving the new single-page Pension Passport were ten times more likely to visit the Pension Wise website compared to those receiving the usual wakeup pack.

Figure 1: Effect of Pension Passport on website visits

Customers sent the Pension Passport were also more likely to call up the Pension Wise booking line. Additionally, we conducted a telephone survey with customers who had been part of this trial. Customers in the treatment group self-reported to be 26.3 percentage points more likely to start with the Pension Wise website as a next step in their retirement journey relative to the control group and 24.1 percentage points more likely to say the information they were sent prompted them into taking action.

The full report details two further trials that made small changes to the existing wakeup pack. With Royal London, the standard Pension Wise signpost letter was placed at the front of the wakeup pack instead of somewhere in the middle and the letter was addressed to the individual by name rather than by Sir or Madam. With Standard Life, we used bright orange paper to make the Pension Wise signposting letter stand out among the other documents in the wakeup pack.

Download report for full results

What next?

There are few decisions we face more important than how we prepare for our retirement. Making informed decisions about retirement options can have a huge impact on peoples’ future income and quality of life, yet for many consumers, information about retirement options can feel complex and overwhelming.

By distilling the wakeup pack into one page of simple, salient and personalised information, alongside a checklist of next steps, we increased engagement with the Pension Wise website and calls to the Pension Wise booking line.

In light of these findings, LV= has committed to overhauling all wakeup packs to effectively signpost consumers to guidance and advice about their retirement options. We are delighted that LV= will be sending the Pension Passport to all of their pension customers and we encourage other providers to follow LV=’s lead and make similar changes to wake up packs. Widespread use of the Pension Passport could have a significant impact on the numbers of consumers seeking pensions guidance and, in turn, contribute to better outcomes for consumers in retirement.

We are thrilled with the success of the Pensions Passport, however take up of guidance remains low overall. Going forward, more intensive interventions could be explored to ensure that people are getting the help they need at retirement. For example, Pension Wise appointments could be provided by default to certain vulnerable consumers. The wakeup pack could provide a time and date for a telephone appointment – with the customer then providing confirmation of their attendance by a specific deadline. This approach could be trialled to see what works to encourage attendance.

Interested in working with us to take forward some of these ideas? Get in touch: elisabeth.costa@bi.team