With the Sugar Tax in force across the UK from today, many people are discussing what costs may be passed on to consumers and how they will react.

It’s an important question, but it misses the key way in which the sugar tax is likely to improve our nation’s health: reformulation.

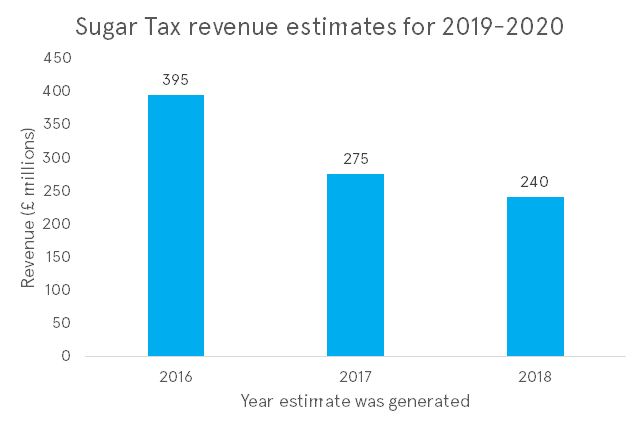

The most recent estimates for 2019-20 sugar tax revenue are down to £240m, from an initial estimate of £500m. A fair chunk of this reduction has come from getting more accurate sales data – the graph below corrects for the initial data error, and suggests that around £155 million will now no longer be collected.

The primary reason for this? Products are being reformulated with lower sugar content so they are either no longer subject to the tax, or fall within a lower tax bracket.

We don’t have the full figures but, given that drinks can either be taxed at 18p or 24p per litre, we can get a rough estimate of the number of litres of drink in a year that have sufficiently reduced their sugar content to no longer be subject to the tax. That would work out at 645-861 million litres of drink with reduced sugar content, i.e. about 3 billion servings (at 250ml recommended serving).1

To put that in context, in 2015 total UK sales for soft drinks that could be subject to the tax was around 5000 million litres (BSDA figures). So we’re talking about 15% of the market reformulating to make their drinks healthier.

It is worth noting that the story on reformulation isn’t exclusively positive. It may mean that some people who would have switched from a full sugar drink to a zero sugar alternative as a result of the tax no longer do so. Their drink of choice may have reformulated to have less sugar in it, but not no sugar. However it’s likely that this is a relatively small effect compared to the impact of all people who continue to consume the brand – we’ve previously written about how we think consumers will react to the new tax.

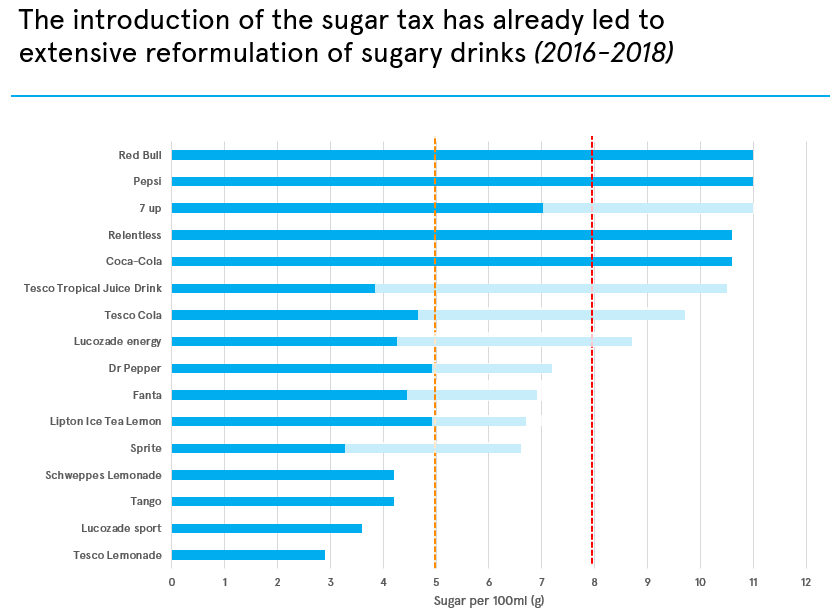

We can also look at a selection of popular drinks to see how things have changed since 2016 when we first blogged about this. Many household name brands have dramatically cut their sugar content including Sprite, Lucozade, Tesco and Irn Bru. Although we don’t know by exactly how much all drinks will have reduced their sugar content, these prominent examples suggest producers aren’t just doing the bare minimum to duck under the threshold.

From a behavioural perspective, reformulation is particularly appealing as it doesn’t require individuals to change their habits to improve their health. Even at this early stage, it seems like the sugar tax has done a lot of good before generating a single penny in revenue.

1 To be conservative in terms of number of litres we’ve assumed no drinks have reformulated from the 24p bracket to the 18p bracket as we believe this will be a relatively small proportion and it could dramatically inflate our figures (though we do note that 7-up falls into this category)