Last week the Competition and Markets Authority (CMA) published the final report of their retail banking market investigation. The CMA has identified that currently, only a tiny proportion of customers switch to a different bank in any year; despite the fact that many of them could save about £90 a year by switching. A quarter of people in the UK use an unauthorised overdraft each year, suggesting they do not have the best account for them: this earns the banks £1.2 billion a year from unauthorised overdraft charges.

The report proposed three foundation measures as the basis for their package of remedies. All three foundation measures have strong behavioural aspects:

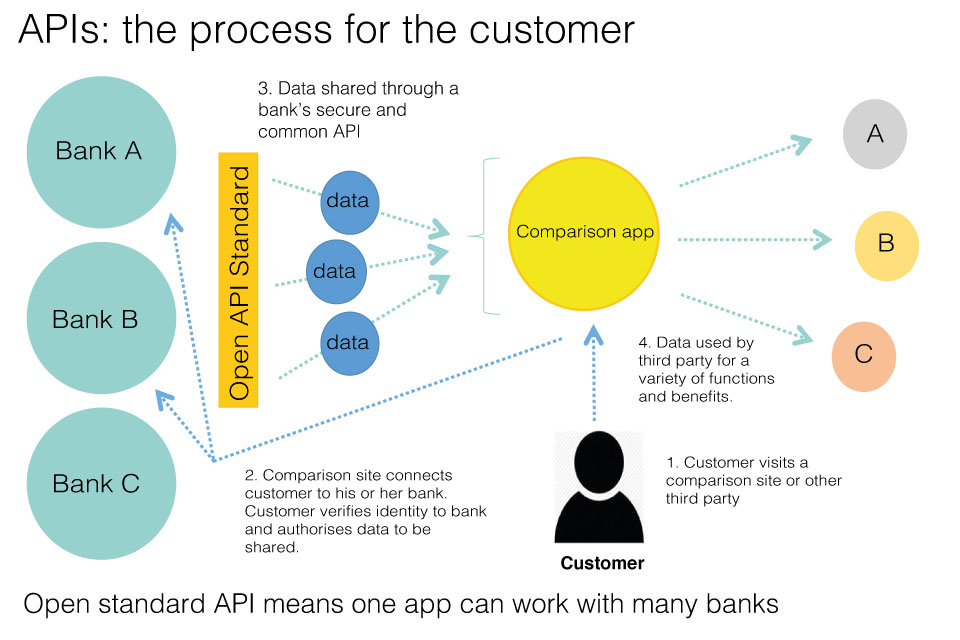

- Requiring banks to implement Open Banking to help consumers share their data securely with other banks and third parties. This will help make it easier for consumers to shop around and compare banking products (making it easy).

- Requiring banks to prominently display a number of core indicators of service quality, including whether a personal customer or small business is willing to recommend their bank to friends, family and colleagues (making it attractive).

- Introducing routine and occasional prompts for personal and business customers to encourage them to consider their current banking arrangements and shop around for alternative banking services (making it timely).

Those of you who have read our recent report on applying behavioural insights to regulated markets will recognise that these remedies strongly echo the principles set down in that paper: we will now set out their behavioural underpinning in a bit more detail.

Open Banking

The introduction of an Open Banking API (application programming interface) builds on a number of other Government policies which BIT has been involved with, and is a great example of a policy designed to ‘make it easy’. Developing an open API standard means that any fintech firm or app developer can design products or apps which work for all UK banks. This might sound like a niche solution aimed at helping data whizzes, but in fact, it has the potential to transform the banking market because it means that consumers from any bank would be able to compare current accounts quickly and easily. It will also help to create a better market for app development and a greater ecosystem for fintech firms and developers to work within.

Source: Call for evidence on data sharing and open data in banking

Back in 2012/13 BIT worked closely with, what was then, the Department for Business, Innovation and Skills (BIS) to design and launch midata. Many markets are difficult for consumers to navigate, requiring individuals to predict their future usage of a product or service and then compare prices between a large range of, often complicated, options. Midata tried to make these markets easier to navigate by giving consumers the right to access their consumption data in a machine readable format, to allow them to compare the price of products based on their actual usage. Our academic advisor, Richard Thaler, has long advocated this approach and even wrote a guest blog post on the topic. While much of the data is now available, it is fair to say that there are still problems with this programme. In particular, the implementation by different companies means that the process a consumer wanting to obtain their midata has to undertake is very complicated and time-consuming. Open Banking has the potential to deliver on the promise of midata and we look forward to seeing consumers starting to benefit.

Publishing service quality indicators

In our recent report on regulated markets we advocated for regulators publishing information that is relevant to consumers to drive competition on quality. Requiring banks to publish information on quality of service on their websites and in branches is an excellent example of using data to actively and directly inform consumers and market players about market performance. Publishing this information helps consumers, and banks, judge performance easily and quickly.

Of course, how, when, and where this information is available is key and it must be both easy to use and catch people’s attention at the right time. An important part of making it easy and attractive is to ensure that the information is aggregated so that consumers can make comparisons between banks. Some of this work has already begun, with HM Treasury, the Financial Stability Board and British Chambers of Commerce publishing information on how likely consumers are to recommend their business bank account. This is based on factors such as transparency of charges, how well their business banking provider understands their business, and how competitive their interest rates are.

Another exciting initiative in small and medium sized (SME) banking is the Nesta challenge prize for small business, which we have supported and followed with interest. The CMA strongly endorsed the challenge prize, including by requiring banks to provide Nesta with financial backing and technical support. This structured prize process will fund participants to develop innovative, data-driven solutions to help small businesses to make easy comparisons between business current accounts and loans, including on charges, service quality and credit availability.

Periodic and event-based prompts

Banks will be required to send their customers periodic prompts (for example, annual statements) or event-based prompts (for example, when a local branch closes or fees are increased) to review their current accounts.

The behavioural literature provides strong support for the use of ‘trigger points’, as an effective way to encourage customers to consider changing their current account. Timely reminders have been effective at encouraging a range of behaviours, including increasing savings and increasing attendance at doctors appointments. There are a couple of reasons for this. First, people have limited ‘bandwidth’ which means they are unable to pay attention to all the different decisions they could, or should, be making at a given time, and therefore react positively to reminders. Second, people are more likely to make big changes (such as changing consumption and travel behaviour) at key changes in their life (e.g. moving house, starting a new job, or having a child).

Of course, the impact of these reminders will depend on the details. Encouragingly, all banks will be required to work with the Financial Conduct Authority (FCA) to test, including through randomised controlled trials, which prompts are most effective at changing customer behaviour. This programme of testing will not only identify the most effective prompts but ensure that the prompts are refined and improved over time. For example, the tax authority in the Netherlands used Post-It notes to draw attention to their tax letters and to stimulate a quick response, which had a positive effect on tax payments. Although the impact of the Post-It notes slowly wore off, simply changing the colour of the notes increased effectiveness again.

These proposals are a good example of a regulator using behaviourally informed remedies to address long-standing problems within a market and the requirement to test and refine the different approaches also gives the flexibility to ensure the remedies continue to deliver benefits over time.