Back in March of this year, the government announced the introduction of a soft drinks levy (or ‘sugar tax’). At the time, we published a blog pointing out that the levy’s success would depend greatly on how producers responded to it. Although shifting customer purchases is important, we predicted that the biggest health impacts would come from producers reformulating their drinks to reduce sugar.

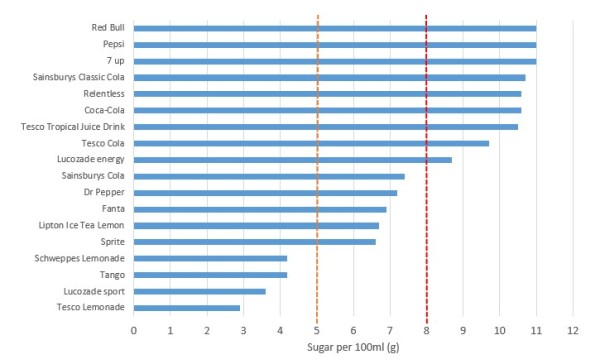

We noted that two design features made it clear that reformulation was a key aim of the levy. First, the levy wasn’t coming into force until April 2018, meaning that producers would have two years to make changes to their drinks. Second, the tax was divided into two tiers: drinks with more than 8g of sugar per 100ml would face a higher levy than those with more than 5g of sugar (we used the graph below to illustrate this point). These tiers meant that producers have a clear incentive to reformulate their products and avoid a higher levy.

Although we predicted that manufacturers would respond positively, it was still unclear how far and how fast this would happen. However, in the past week, we’ve started to see the answer. First, on Monday Tesco announced that all its own-label soft drinks would be reformulated so that they are exempt from the levy. Then, on Wednesday Lucozade Ribena Suntory also revealed that all of its brands will escape the tax. This means cutting sugar by at least 50 per cent for Lucozade and Ribena, with the company describing the move as a ‘game changer’.

Given these significant changes, we can expect many other producers to follow suit. This means that, interestingly, the soft drinks levy is starting to have a large impact even before it comes into force – not by affecting purchases, but by influencing producers.