If you are an investor, do you know how much your investment dealer receives in fees for the services they provide to you? If not, you are certainly not alone. Investment fees are complex and sometimes opaque – but they matter, especially as their impact on returns compounds over time.

Disclosure requirements are a common regulatory tool designed to help people make better decisions for themselves, but they do not always have their intended effect. For example, their impact is limited where consumers fail to read the disclosure or do not really understand it.

We recently worked with the Ontario Securities Commission’s Investor Office to figure out how insights from the behavioural sciences could be used to improve the reports that Canadian investors receive about the fees they pay. These fees are a relatively recent regulatory requirement under the “CRM2” framework. We looked at comprehension of the fee report information and how to encourage investors to get more value for the fees they pay—or reduce them.

We started with the barriers. Why aren’t more Canadians engaging with, comprehending, and acting on these reports? Our research suggested 11 key barriers, in which comprehension often played a key role. For example, cognitive shortcuts may lead investors to underestimate how the impact of fees adds up over time. Then we turned out attention to potential solutions, identifying 24 potential changes to the fee report structure and content. You can read about all our ideas in the full report.

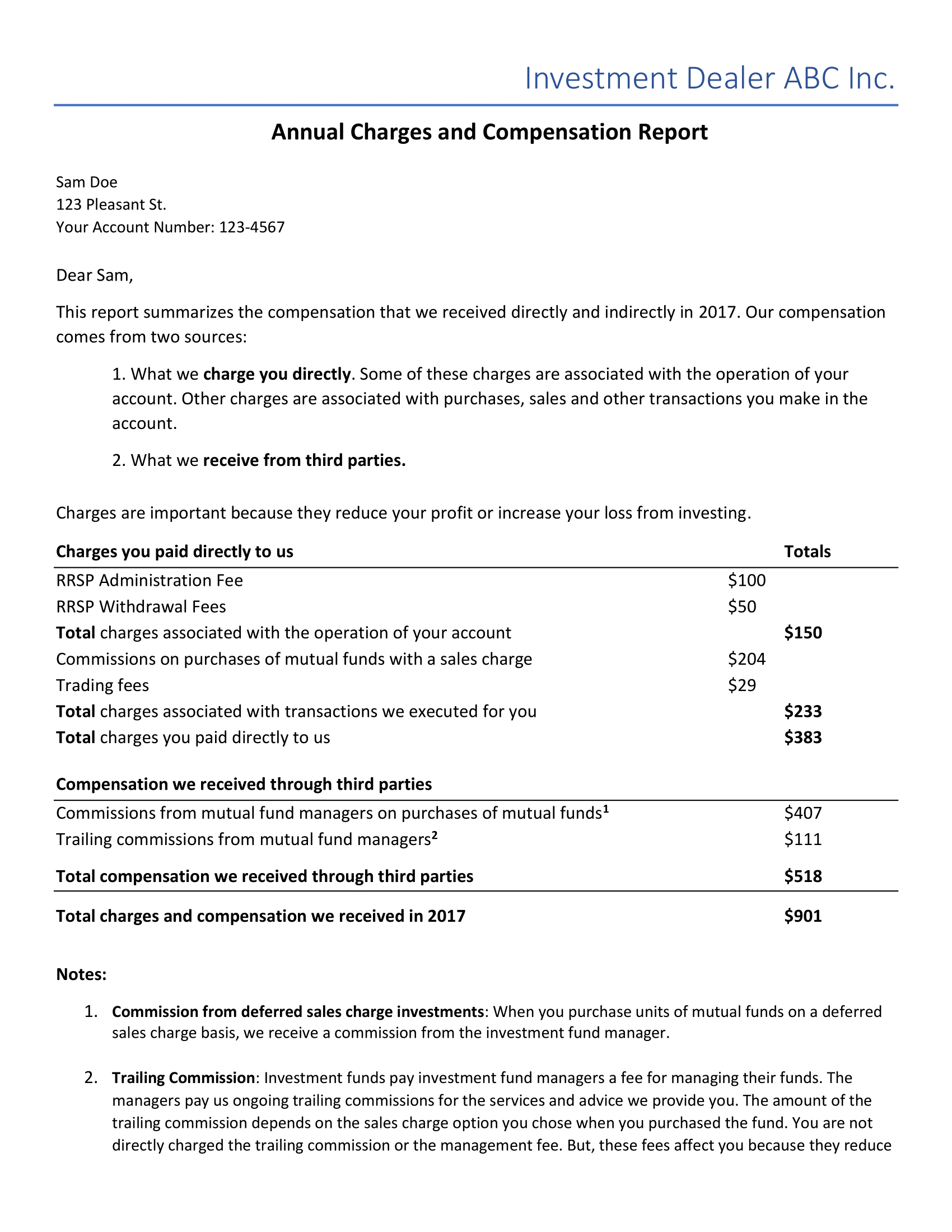

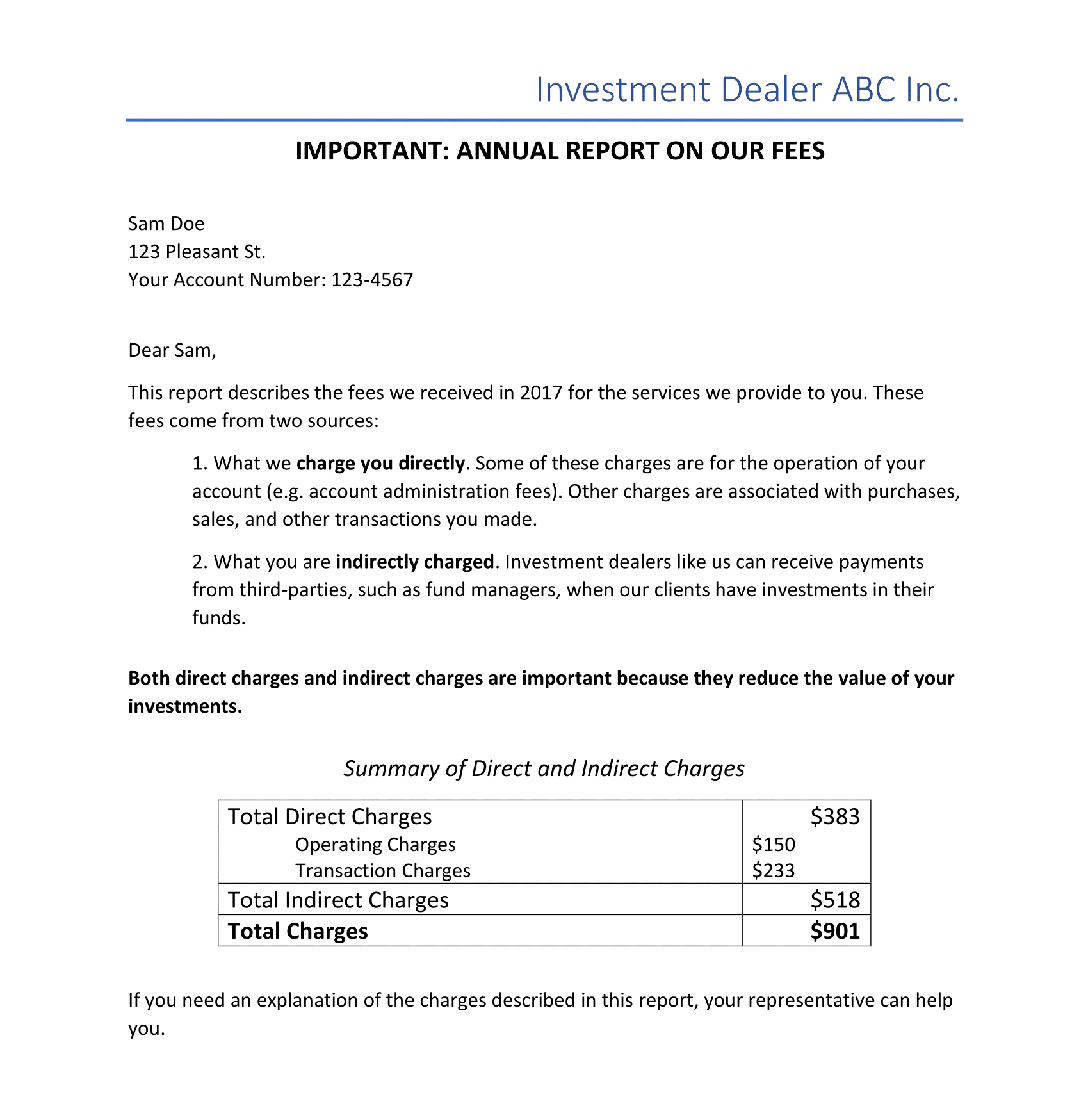

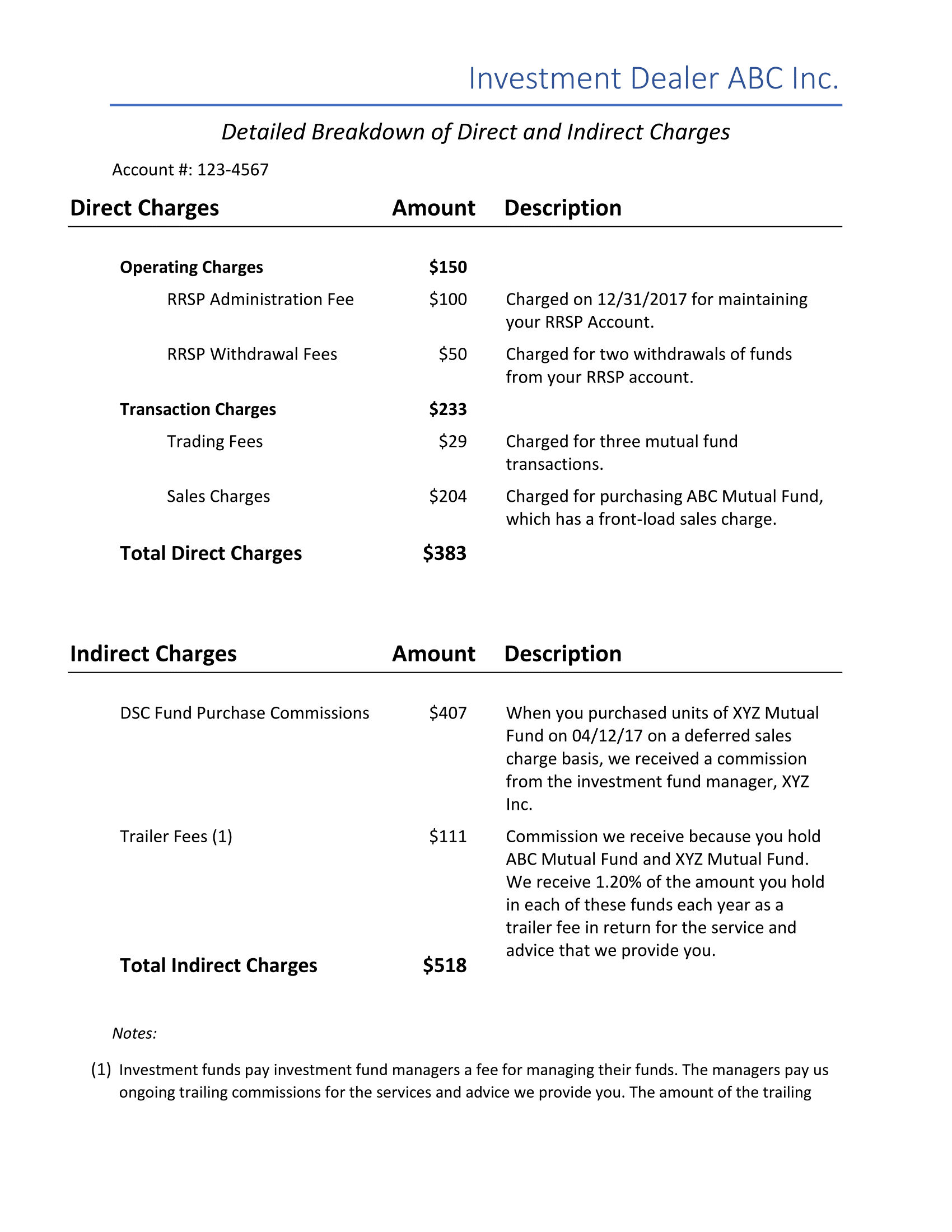

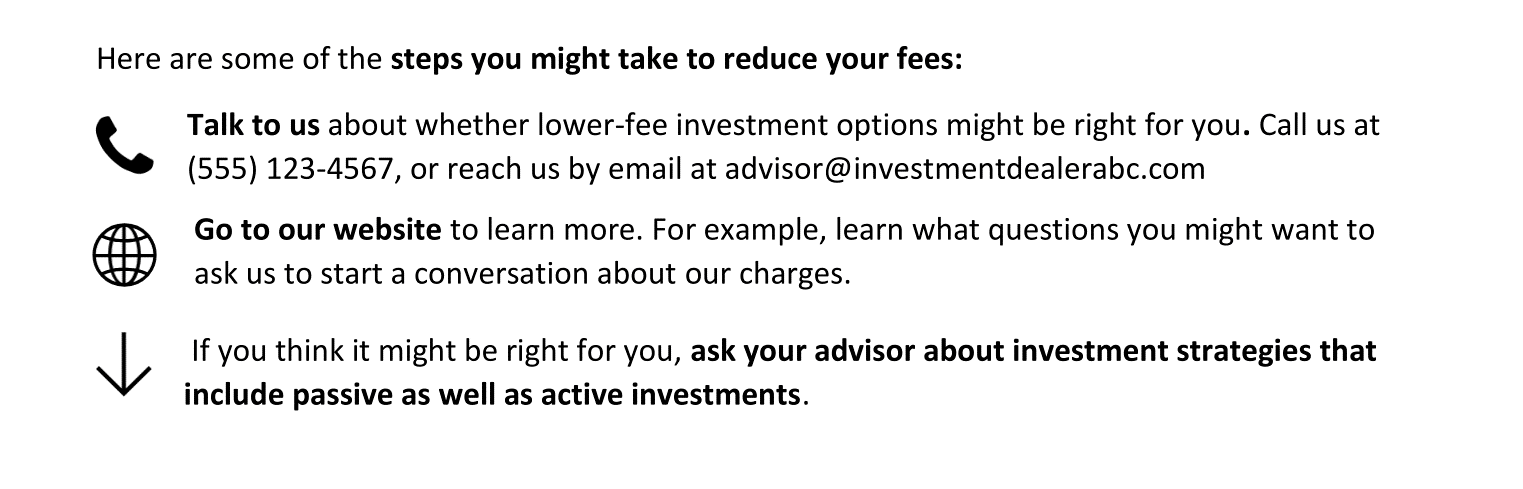

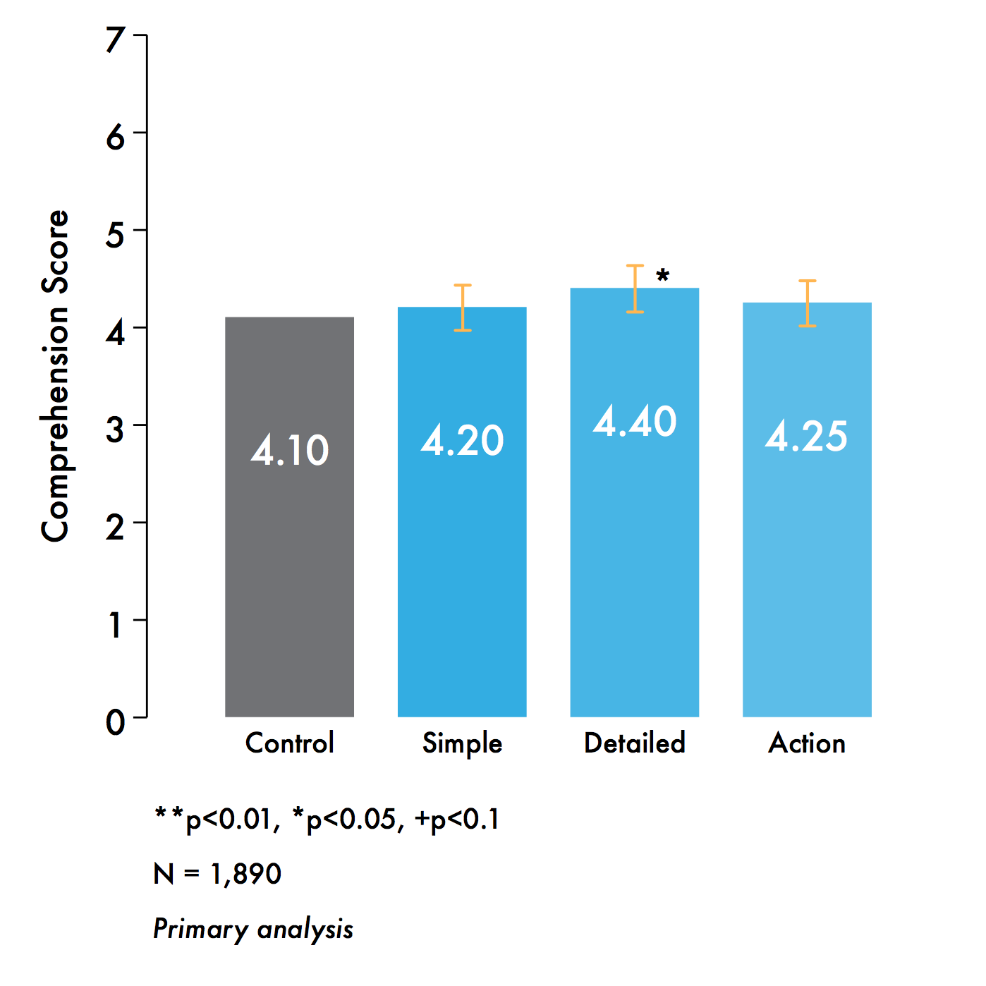

Even better, we were able to empirically test several of our ideas through an innovative online trial with a sample of almost 1900 Canadian investors, leveraging the Predictiv platform BIT developed. In this trial, each investor viewed one of four versions of a sample Annual Fee Report and was subsequently asked a series of comprehension questions. The Simple version of the Annual Fee Report tried to address the barrier of “information overload” by minimizing the volume and complexity of the information provided. The Detailed version took the Simple version and added a second page with a thorough but clear breakdown of the fees. The Action version was a modified version of Simple that included a list of three actions that investors might want to take upon reading the report.

“Control” version of the fee report (page 1 of 2)

“Simple” treatment (page 1 of 1)

“Detailed” treatment (page 2 of 3; the “Simple” treatment would be page 1)

Suggested steps from “Action” treatment (bottom of page 1 of 1; the rest would be identical to the “Simple” treatment)

We found that showing investors a Summary + Detail version of the fee report worked the best to improve comprehension of investment fees, a 7% increase relative to control.

Our results suggest that providing investors with a simple summary of the most critical information, supplemented with a detailed description of fees and an explanation of why those fees were incurred, can be effective at boosting comprehension.

However, we recognize that the size of this effect is modest, and certainly won’t close the understanding and action gap. Our report advises investment firms, regulators, and other stakeholders to develop and test other ways of building investor understanding and helping investors take that critical addition step from understanding to informed action.