Four Perspectives on Embedding Behavioural Insights into Company Policy

How can business leaders promote, apply, and embed behavioural science within their organisations?

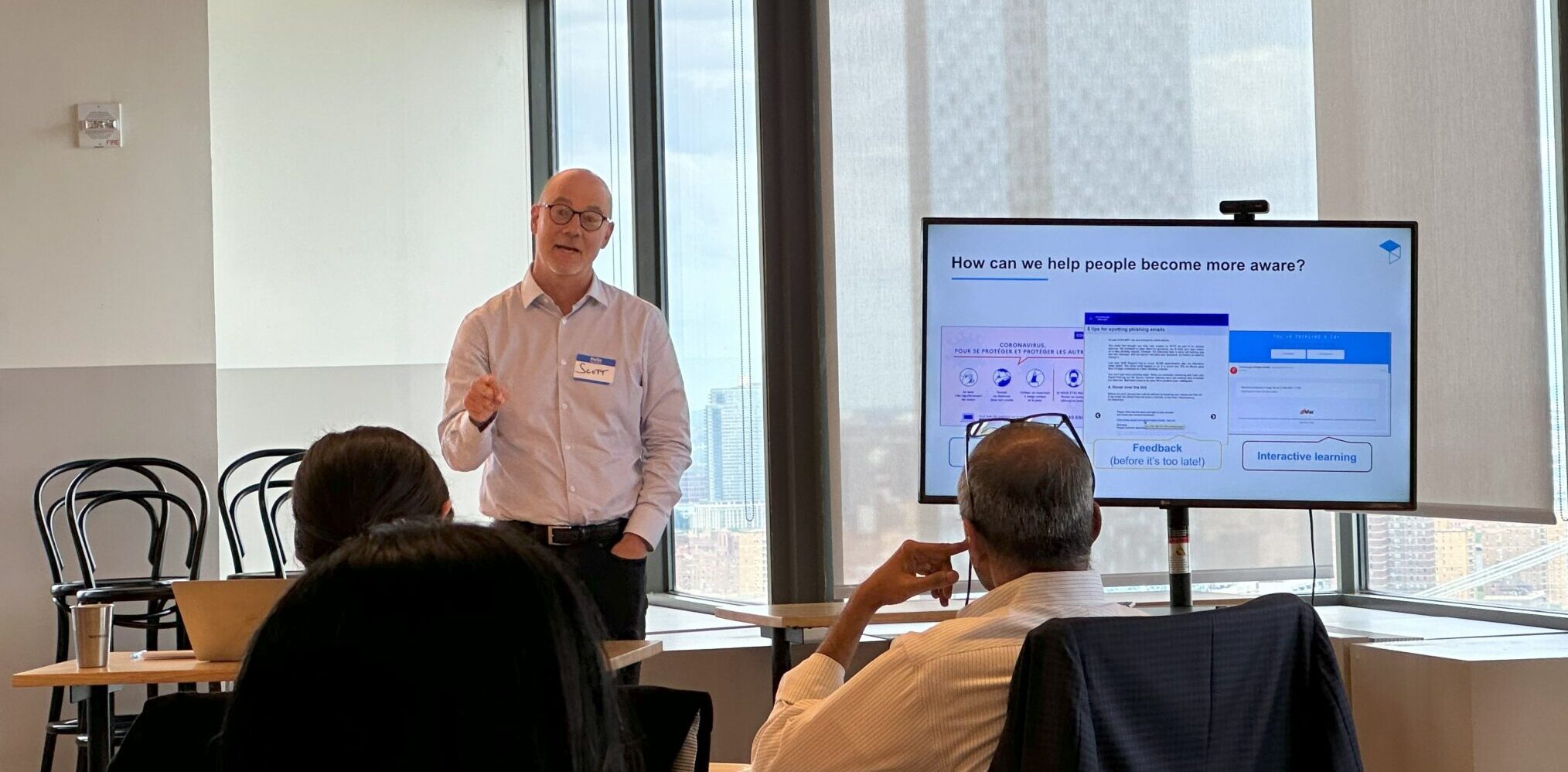

Including behavioural insights in company policy is something all business leaders should be striving towards to create inclusive and positive places to work that benefit both employer and employee. At a half-day seminar in New York City, co-hosted by The Behavioral Insights Team (BIT) and Behavioural Economics in Action at Rotman (BEAR) University of Toronto, we explored this.

The event featured presentations from Dilip Soman, Michael Hallsworth and Scott Young along with a panel of business leaders who shared their experiences heading behavioural insights teams and initiatives within financial services organisations. The team here at BIT have outlined four of the most important themes that emerged.

Adopting Behavioural Science into Policy

In his opening presentation, Professor Dilip Soman of the Rotman School of Management focused on the ongoing challenge of adopting behavioural science into organisations. He applied the analogy of electricity, which required over 40 years for widespread adoption, and made the distinction between “point” solutions (which improve existing efforts) and “system” solutions (which create new opportunities, yet require system change).

We need to leverage behavioural science beyond quick wins and do more than just change messaging.”

Soman then shared a framework of point and system opportunities for Behavioral Science – ranging from “easy sells” to “smash hits” and “long haul efforts” – and emphasised the importance of pursuing a portfolio of initiatives. He proposed that: “We need to leverage behavioural science beyond quick wins and do more than just change messaging.”

Professor Soman concluded by sharing a series of ideas for driving adoption and shared a vision in which Behavioral Science (like electricity) is everywhere and “part of the DNA” of organisations.

Moving Beyond the Nudge

Our panel of leaders, Jaclyn Kalter (Vanguard), Jeff Kreisler (JP Morgan), and Melissa Knoll (Fidelity), are all part of organisations that have made commitments to establish behavioural science functions. Yet, each leader still faces similar obstacles in introducing their capabilities to colleagues and in demonstrating their added value and ROI to senior management.

Jeff spoke to the challenge of measuring impact, commenting: “Wealth management measures success with dollars in the bank – what about behavioural science?”

We were lucky to be there as they shared strategies for approaching such challenges. A common thread was the importance of engaging with colleagues earlier in their planning cycles, so that they could influence processes and development efforts, rather than incorporating a few nudges (“sprinkling on some behavioural science”) to a product or service offered at the very end of a process.

For example, Jaclyn was able to create a cross-disciplinary team spanning behavioural science, digital analytics, digital experience, and financial technology, as part of a strategy to build behavioural science into the fabric of these departments.

Three Promising Opportunities

Scott Young’s presentation centred on identifying the best opportunities to apply behavioural science both effectively and ethically. To this end, he began by sharing the guiding principle of “win-win-win” opportunities, which are behaviour changes that are beneficial to organisations, their stakeholders, and society.

He then focused on three areas – Consumer Protection, Compliance, and Human Resources – with shared characteristics that make them particularly well-suited to a “behavioural science lens.” Namely, these functions have well-established challenges (such as fraud, employee retention, and DEI) that draw significant ongoing investment and rely heavily on traditional approaches (which have brought mixed/modest results).

Young then shared examples of BIT’s recent work in these areas, including a large-scale simulation to help consumers become more resistant to fraud efforts, as well as a series of insights to promote employee engagement and reduce burnout. He concluded with advice for introducing behavioural science to business leaders, including the importance of framing behavioural science as a new way to approach their current challenge.

Rather than leading with behavioural science, we need to start with the problems that leaders are already trying to solve – and then show them how behavioural science can provide a new way of making progress against these challenges”

“Wiring the House” with Behavioural Science

Dr Michael Hallsworth took a clear-eyed and critical look at the future of behavioural science as a field. Sharing excerpts and ideas from his new landmark work, A Manifesto for Applying Behavioral Science, Michael provided a brief overview of ten proposals to take behavioural science to its next stage. He then zeroed in on the challenge of building behavioural science into organisations.

Michael emphasised that, despite the growth and success of many internal nudge units, we shouldn’t limit ourselves to thinking only about building bigger and better internal units. We should also explore ways to infuse behavioural science into the key functions of organisations, such as decision-making processes, incentives, and budgeting.

Complimenting Professor Soman’s reference to electricity, he provided the analogy of “wiring the house” with behavioural science, as opposed to only building a large room (i.e. a nudge unit). This parallel approach will not only extend the reach and impact of behavioural science but also provide greater resilience against budget cycles and changes in leadership. It will also move us closer to the end goal of “behaviorally-enabled organisations,” in which knowledge and application are diffused across the institution, rather than concentrated in the minds of several individuals.

Discover Behavioural Insights Expertise at BIT

Behavioural Insights are quickly becoming a workplace necessity. Learn how you can introduce behavioural science and insights to business policy with the help of our expert team at BIT.

Get in touch today to find out more about how we can help you, or check out our other insights on our blog today.